- Minds x Machines

- Posts

- Vanguard 2026 Economic Outlook

Vanguard 2026 Economic Outlook

AI Exuberance: Economic Upside, Stock Market Downside

I thought it might be interesting to dig a bit deeper into Vanguard’s Economic and Market Outlook for 2026. Go and read it. Please note that none of this is financial advice. I’m exploring what has been said about AI opportunities, risks, bubbles, etc.

A Balanced View

Another analysis that I really enjoyed (and gives another perspective) is Aswath Damodaran’s Trillion Dollar Market Caps: Fairy Tale Pricing or Business Marvels?

Read my Post: the Big Market Delusion, when each company's story may be individually plausible, but when aggregated, they claim more of the market than exists. The market is not big enough to sustain all winners.

Let’s get into it.

Vanguard economic and market outlook for 2026

AI exuberance: Economic upside, stock market downside

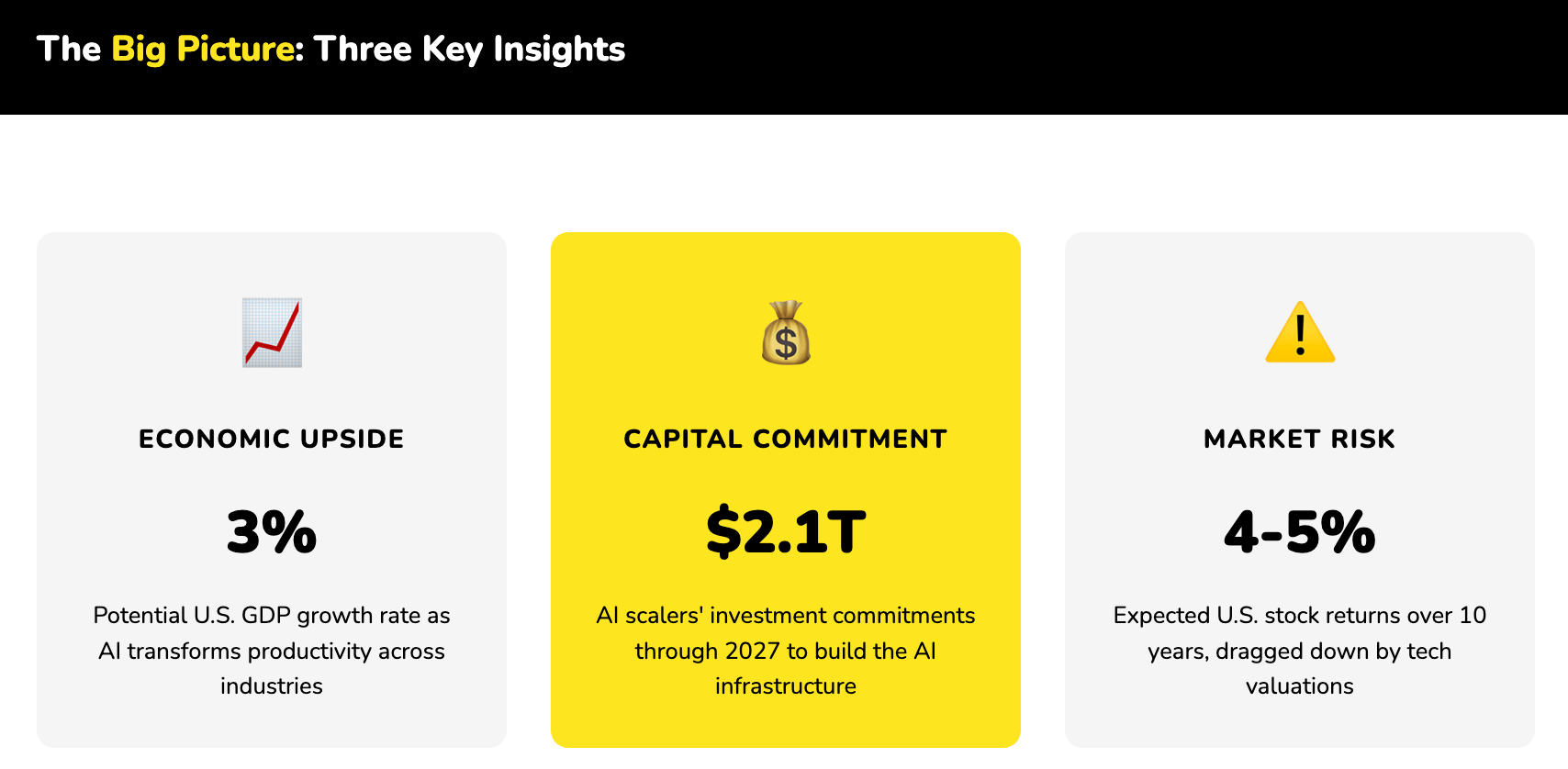

AI's rapid evolution presents a paradox for investors: while the technology promises to transform productivity and drive 3% economic growth, the stock market darlings leading this revolution face mounting risks. Here's what you need to know.

Why This Report Matters: The AI Investment Paradox

Vanguard's 2026 outlook reveals a fascinating paradox that every investor should understand: AI has the genuine potential to become a transformative economic force, delivering productivity gains not seen since the industrial revolution. Yet the very companies driving this transformation may not be the best investments going forward.

This isn't a bearish take on AI itself. Quite the opposite. Vanguard sees an 80% chance that economic growth will diverge from consensus expectations, with AI capital investment being the key differentiator. The critical insight is understanding the difference between economic winners and investment winners during technological revolutions.

The history of investing during technology cycles reveals some counterintuitive investment opportunities. Economic transformations are often accompanied by equity market shifts over the full technology cycle.

The report draws parallels to previous technological buildouts, from railroads in the 1850s to telecommunications in the 1990s. In each case, the companies that ushered in the transformation weren't necessarily the ones that delivered the best long-term returns. The winners often emerged from unexpected places: the adopters and enablers rather than the pioneers.

The AI Capital Investment Cycle: A $2.1 Trillion Bet

Since ChatGPT emerged in late 2022, AI investment has contributed roughly $250 billion to U.S. GDP. While this sounds substantial, historical comparisons put it in perspective. As a share of GDP, the current AI capital investment cycle is tracking past buildouts closely, suggesting we're still in the early stages of a multi-year transformation.

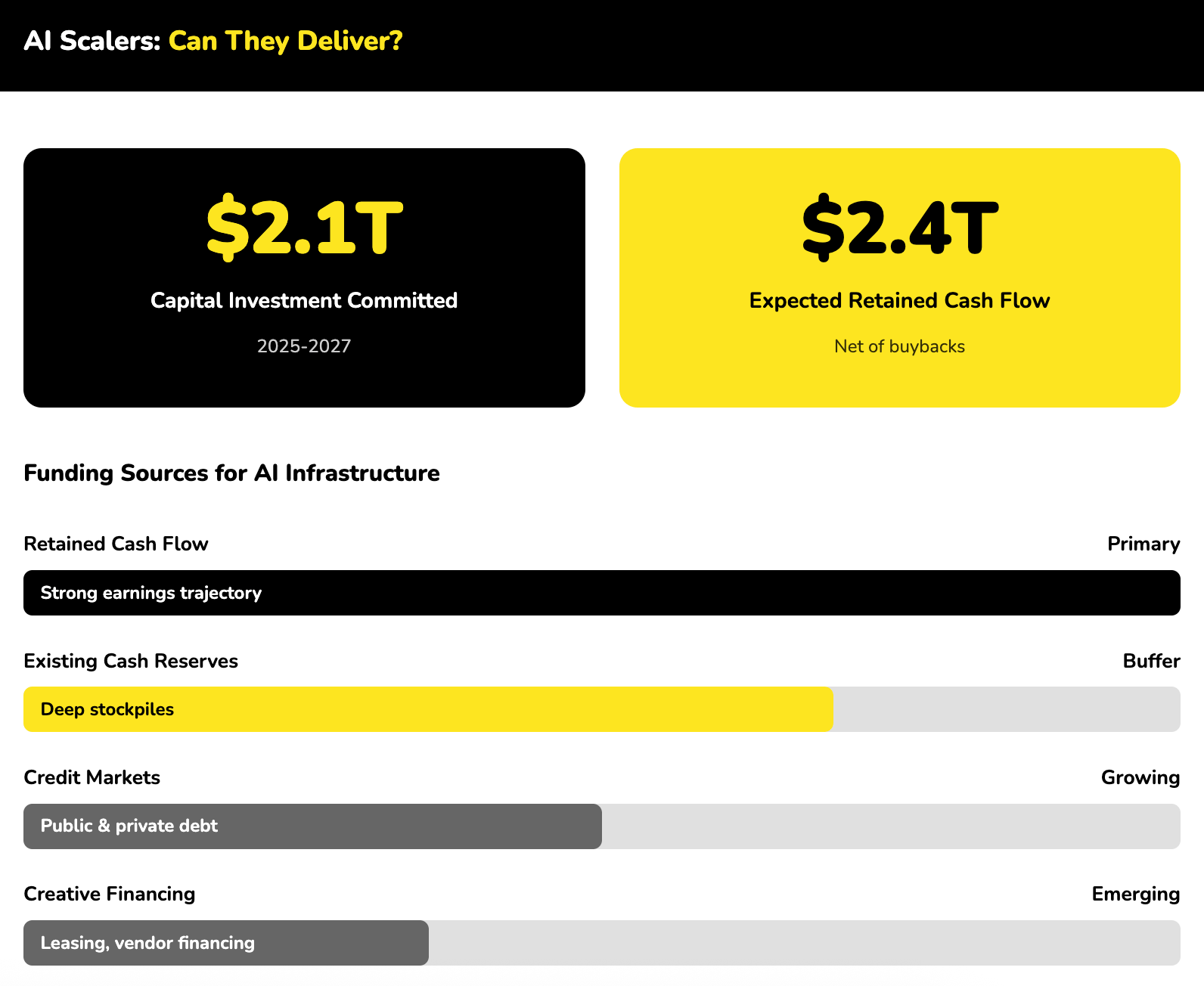

What makes this cycle different is the scale of commitment from "AI scalers": the major tech companies including Amazon, Alphabet, Microsoft, Meta, Nvidia, Apple, Oracle, and Tesla. These companies have committed to $2.1 trillion in capital investment through 2027, representing the bulk of AI-enabling infrastructure.

Three Phases of AI Adoption

2023-2024: Experimentation — Businesses and consumers explored AI capabilities, growing comfortable with the technology

2025: Broader Adoption — Key AI scalers deepened AI integration into cloud platforms, with enterprise adoption accelerating

2026: Workflow Integration — AI becomes embedded in business workflows, with close monitoring of productivity impacts

AI scalers have the financial wherewithal to fund these investments. With large cash stockpiles, strong balance sheets, and consistent earnings growth, the market expects they'll remain profitable enough to cover the planned $2.1 trillion investment.

The Productivity Promise: Universal but Uneven

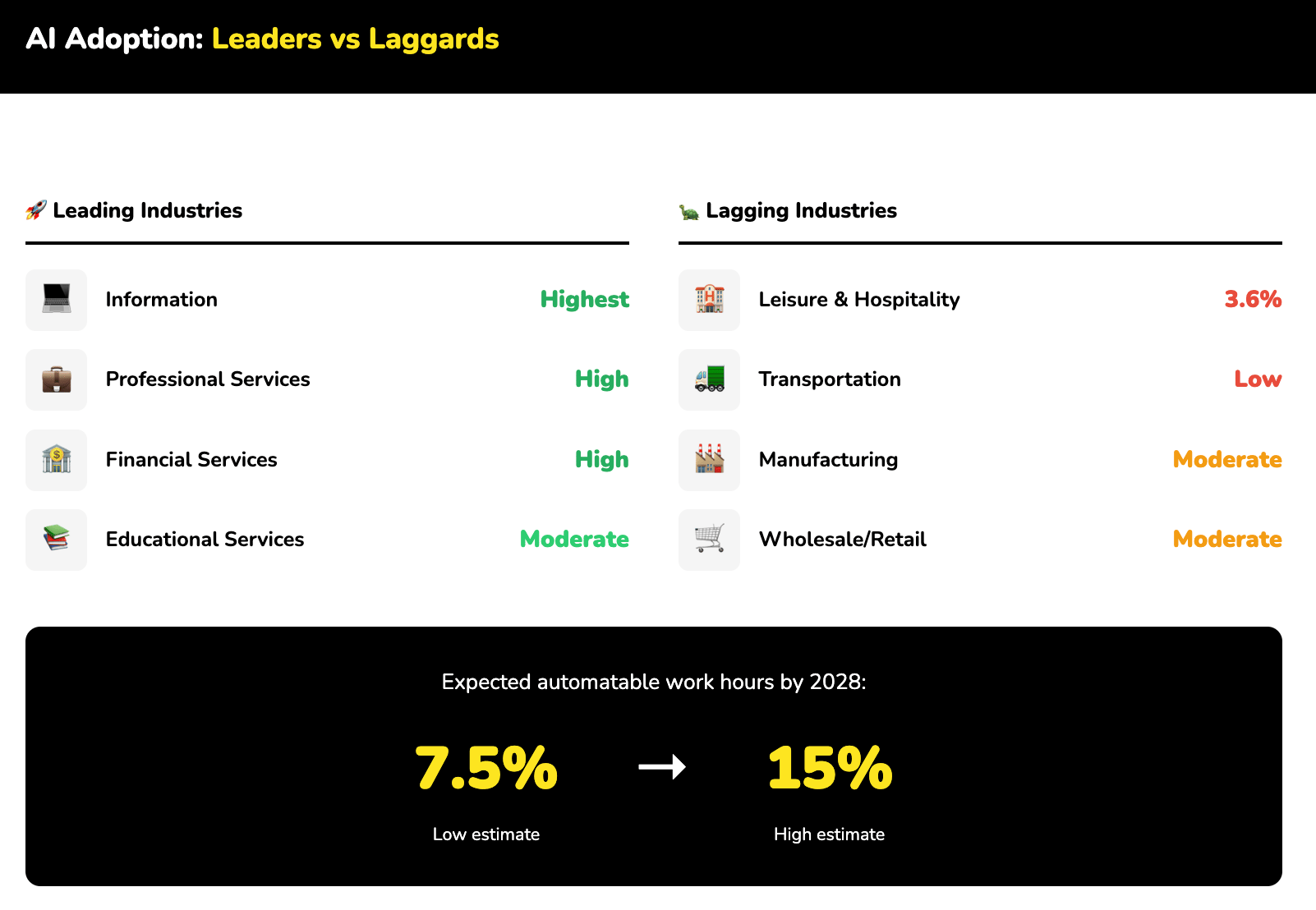

Vanguard's task-based framework reveals something surprising: AI's productivity potential is more universal than commonly assumed, even in industries traditionally seen as physical and less suited for automation. The key insight is that all industries spend considerable time on rules-based cognitive tasks, which current AI tools can dramatically accelerate.

However, industry-level adoption rates vary dramatically. Information and professional/financial services are leading the charge, while transportation, warehousing, and hospitality lag significantly behind. This uneven adoption means productivity gains will be concentrated but significant in the near term.

What's Actually Happening in the Labour Market

Despite headlines about AI job displacement, the data tells a different story. The approximately 100 occupations most exposed to AI automation are actually outperforming the rest of the labour market in both job growth and real wage increases. This suggests current AI systems are enhancing worker productivity rather than replacing workers wholesale.

Entry-level employment challenges reflect broader labour market dynamics, not AI-specific disruption. While large language models excel at aptitude tests, they still struggle with real-world scenarios requiring nuanced decision-making.

The potential for a genuine productivity boom is real but not guaranteed. If AI becomes a true general-purpose technology that diffuses throughout all sectors, real U.S. GDP growth could average 3% between 2028 and 2035. Achieving this would require AI capabilities to augment roughly 30% of total working hours by 2035, up from the current estimate of 12%.

The Investment Paradox: Why AI Winners May Not Be Stock Winners

Here's where Vanguard's analysis becomes genuinely counterintuitive. Despite their bullish view on AI's economic impact, they maintain that U.S. growth stocks, particularly the tech giants driving AI investment, face significant headwinds. Their projected 10-year return for U.S. equities of just 4-5% is almost entirely driven by concerns about large-cap technology valuations.

Two Reasons for Caution

First, expectations are already sky-high. The market has priced in continued exceptional earnings growth from AI scalers. Any disappointment, whether from slower adoption, competitive pressure, or simply the massive capital requirements, could trigger significant repricing.

Second, history shows that pioneers rarely stay on top. Creative destruction is a fundamental feature of technological revolutions. Many of today's AI scalers didn't exist during the dot-com era, and many of tomorrow's winners may be unknown today. Consider Nvidia: as recently as 2013, it was only the 380th-largest company in the S&P 500. In 2025, it became the first to reach $5 trillion in market capitalisation.

The emergence of DeepSeek in early 2025 demonstrated how quickly the competitive landscape can shift. New entrants can leverage existing infrastructure to reshape markets, just as today's tech giants built their businesses on the internet infrastructure of the 1990s.

Vanguard's Recommended Investment Strategy

Given this analysis, Vanguard recommends a significant departure from conventional wisdom. Rather than doubling down on the AI winners that have driven recent market returns, they suggest investors look elsewhere for the best risk-adjusted returns over the coming decade.

The Investment Hierarchy

Vanguard ranks the strongest risk-return profiles in this order:

High-quality U.S. fixed income — With projected returns around 4% and genuine diversification benefits if AI disappoints

U.S. value-oriented equities — Industrials, financials, and consumer segments positioned to benefit from AI adoption at more reasonable valuations

Non-U.S. developed markets equities — International diversification with better risk-reward profiles than U.S. growth stocks

The logic is elegant: as AI diffuses across all sectors, value-oriented companies that adopt the technology effectively may see greater earnings improvements than the pioneers who built it. This pattern has repeated in previous technological revolutions.

This portfolio serves dual purposes. It's positioned to benefit as AI transforms the broader economy, capturing gains from adopters rather than just builders. But it also provides protection if AI enthusiasm proves overdone, with bonds offering real returns regardless of what central banks do.

The Global AI Race: U.S. and China Lead, Europe Lags

The global landscape of AI adoption and investment is highly uneven. The United States and China dominate, while Europe remains concentrated in traditional industries like automobiles and pharmaceuticals rather than future-oriented sectors like software, semiconductors, and AI.

Regional Dynamics

United States: Leads in innovation with a dynamic start-up ecosystem. Over 6,900 private AI start-ups have received significant funding, outnumbering all publicly traded U.S. companies. The combination of capital markets depth, talent concentration, and entrepreneurial culture creates a formidable position.

China: Set to adopt AI even faster than the U.S. in some respects. World-leading digital payments, e-commerce, and mobile ecosystems provide fertile ground for rapid deployment. However, demographic headwinds and a higher share of physically intensive sectors may create a productivity ceiling sooner than in the U.S.

Europe: Expectations for productivity growth are considerably lower, reflecting slower AI adoption, less dynamic capital markets, and more rigid labour and product markets. The region's R&D spending remains concentrated in traditional sectors rather than AI and software.

If accelerated AI adoption and meaningful institutional reforms happen in Europe, these developments could materially reshape the region's medium-term growth outlook. But this represents upside risk rather than baseline expectation.

Creative Destruction: Why Tomorrow's Winners Look Different

Perhaps the most important insight from Vanguard's analysis is about creative destruction. Since the 1970s, the United States has dominated global technology through an innovative ecosystem that continuously spawns transformative companies. But early leaders in tech revolutions rarely maintain dominance indefinitely.

The dot-com boom provides a cautionary tale. Many of the Nasdaq darlings from the 1990s faded into obscurity after 2000, even as continued adoption of internet and personal computers kept productivity elevated. Most of today's AI scalers were either unknown or non-existent during that era.

The Next Generation

As AI becomes embedded across sectors beyond IT, from professional services and logistics to healthcare and education, the entrepreneurial frontier will expand beyond core AI developers. The next wave of innovation may come from:

Efficiency innovators — Companies finding solutions to current AI bottlenecks in compute, energy, and data

Domain specialists — Firms building AI applications for specific industries with deep expertise

Integration experts — Companies solving complex last-mile challenges in real-world deployment

Private AI start-ups in the U.S. now outnumber all publicly traded companies: 6,956 versus 4,010. The next Nvidia may well be among them, currently unknown and too small to register on most investors' radar.

The Key Risks: What Could Go Wrong

Vanguard's analysis isn't without uncertainty. They identify several key risks that could shift the outlook significantly in either direction.

Downside Risks (25-30% probability)

The most significant downside risk is that AI fails to deliver the hoped-for productivity gains. This could happen if the current paradigm of compute-heavy AI capability improvement hits fundamental limits, or if the hoped-for quantum leap in AI capability remains elusive. In this scenario, the massive capital investments would prove poorly allocated, potentially triggering both economic slowdown and market correction.

Upside Risks

Conversely, AI could transform the economy faster and more broadly than expected. If adoption accelerates and productivity gains materialise sooner, economic growth could push toward 3% even in the near term, supporting continued momentum in equity markets despite stretched valuations.

Vanguard's recommended portfolio is designed to perform reasonably well in both scenarios. High-quality bonds provide protection if AI disappoints, while value stocks and international equities capture upside as AI adoption broadens beyond the pioneers.

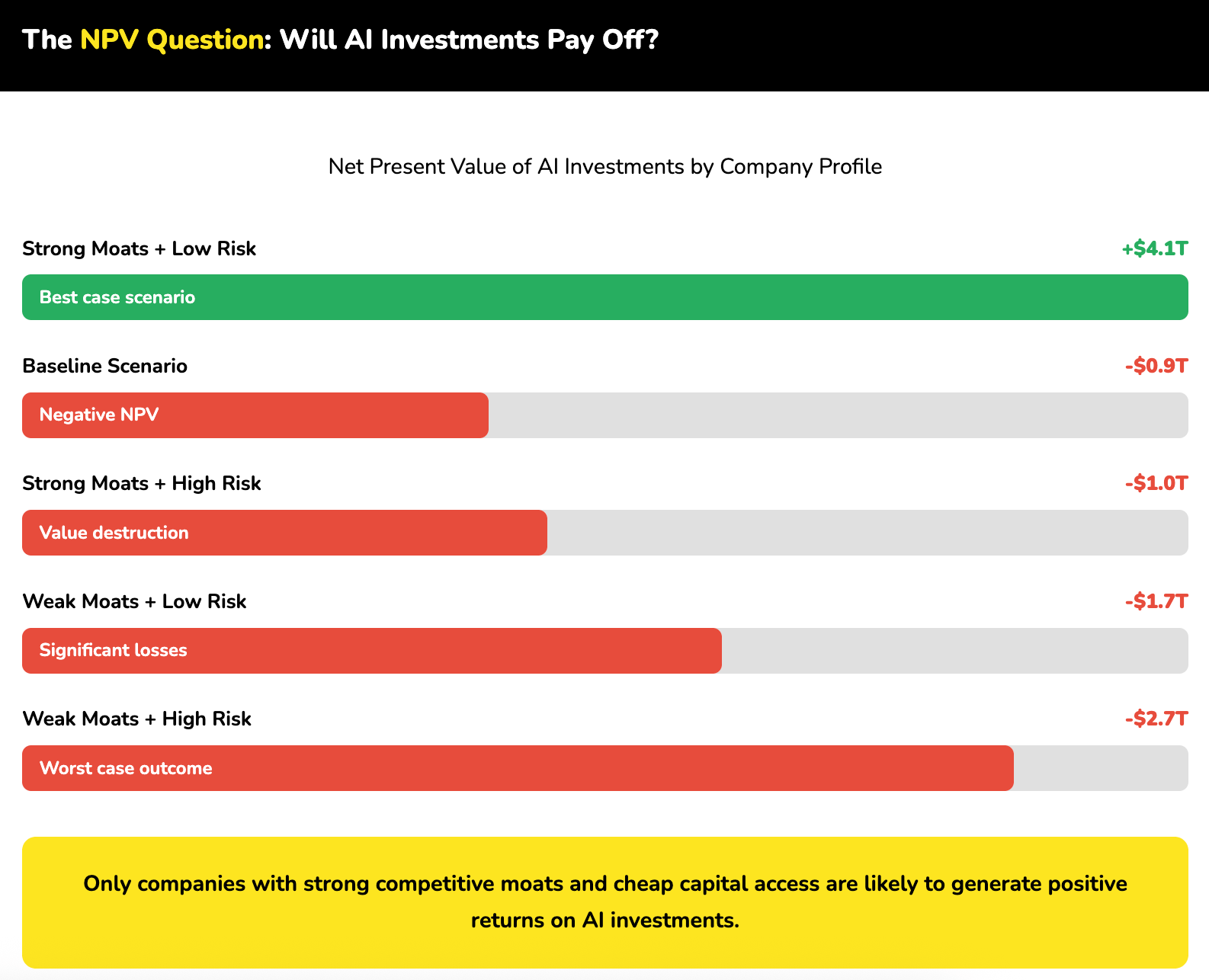

The Net Present Value Question

Perhaps most sobering is Vanguard's analysis suggesting that the aggregate net present value of AI investments may be negative, or at best uncertain. Only companies with strong competitive moats and access to cheap capital are likely to generate positive returns on their massive AI investments. For others, the arms-race dynamics and scale of capital involved create significant risk of underdelivery.

What This Means For You: Actionable Takeaways

Vanguard's analysis offers several actionable insights for investors navigating the AI era:

1. Separate Economic Optimism from Investment Strategy

You can believe AI will transform the economy while remaining cautious about AI-related stocks. These aren't contradictory positions. Historical patterns show that economic winners and investment winners often diverge during technological transformations.

2. Consider the Value of "Boring" Investments

High-quality bonds offering 4% real returns may seem unexciting compared to AI narratives, but they provide both income and diversification. If AI disappoints, they become essential portfolio protection. If AI succeeds, they still deliver reasonable returns.

3. Look for AI Adopters, Not Just Builders

As AI diffuses across the economy, value-oriented companies in sectors like industrials, financials, and consumer services may benefit disproportionately. They get productivity gains without the massive capital requirements facing AI infrastructure builders.

4. Maintain Geographic Diversification

Non-U.S. developed markets offer better valuations and haven't priced in the same level of AI optimism. This provides both diversification and potentially better risk-adjusted returns.

5. Prepare for Volatility

Vanguard explicitly forecasts that volatility in the tech sector, and hence the U.S. stock market overall, is "very likely to increase." Position your portfolio to weather turbulence without being forced to sell at inopportune times.

The recommended portfolio is both offensive and defensive. It captures AI's eventual boost to productivity through value stocks and international exposure, while bonds provide income, stability, and protection against AI disappointment.

Want to make sure you capture the 10% probability of AI upside??

We believe in HUMAN-FIRST, AI FORWARD

Contact us to Build AI leverage inside your business by upskilling the people who know it best

Thundamental is an Ai training and implementation business, and we have a sustainable implementation strategy:

👉 Schedule a free consultation and let’s get started. Or reply to this email.

Don’t want to miss our next newsletter? | Or, if you’re already a subscriber… |